Latest MK45 Property Market Update

Have a sneak read of my latest property market update, a bi-monthly feature The Ampthill & Flitwick Life magazine distributed to 11,500 homes across the MK45 area. This month I talk about property price reductions, land registry data and compare this to the property price crash in 2008. Will properties prices crash and how much by?

The October MK45 Property Market Update

We have seen property prices appear to take a hammering this year with many being reduced but I think we need some perspective and look property prices over the years, comparing now to the last property crash in the 2008/2009 credit crunch.

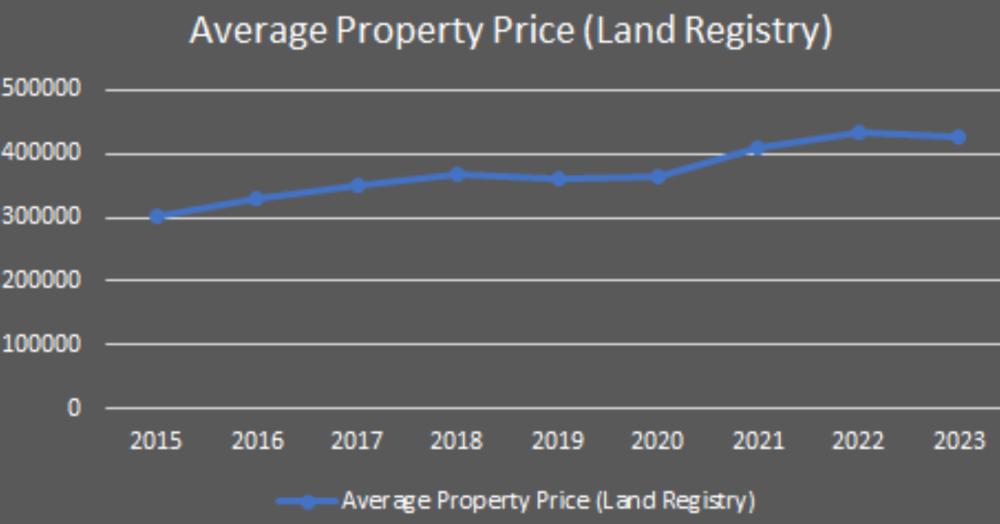

The latest Land Registry data shows prices have been on the rise, with single-digit growth from 2015 to 2018. We had a minor setback in 2019 & 2020 due to Brexit and COVID, but it only knocked about £10,000 from the average MK45 property. Considering those crazy events, the housing market in MK45 showed remarkable resilience.

Now, post-pandemic, house prices shot up, especially in 2021 with a huge 15% increase. Government initiatives like the Stamp Duty holiday played a big role, saving buyers around £7,500. However this led to a bit of panic buying, driving prices even higher than the savings it created. By 2022, we saw prices rise by 22%.

But here's the latest twist: Land Registry reports a drop of £6,000 in the average MK45 property in the first half of this year. Not a huge deal considering all the hype.

Now, remember, Land Registry data is historical and these figures will cover sales from September 2022 to March 2023. In reality, prices may have dipped more. But to match prices from just three years ago, they'd need to fall by a massive 16%. Back in the 2008/2009 credit crunch, MK45 house prices only dropped by 7.5%. Plus, getting a mortgage then was a lot tougher, needing a hefty 20% deposit and squeaky clean credit history however today you can get mortgage with just 5%.

Should we freak out about a housing market crash? Comparing to the 2008/2009 credit crunch, it seems more like a correction than a crash. Those 15% price hikes couldn't last forever, and now we're seeing things balance out. Even a 7.5% reduction would only be half the increase of 2021.

Remember, a property is a home, not just an investment. Its value might make you feel wealthy, but it won't fill your fridge or pay the bills. When you move, the profit or loss is just numbers on paper you transfer to your next home. What matters most is the memories you create.

If you have any questions regarding the current market or your property’s value please contact me on 01525 713111 or email me stuart@lovehomes.uk.