Today we are looking at the local property market, what the trends are showing and what really happened with property across MK45.

The MK45 property market

Today I have delved into the local property market and in particular the MK45 property market.

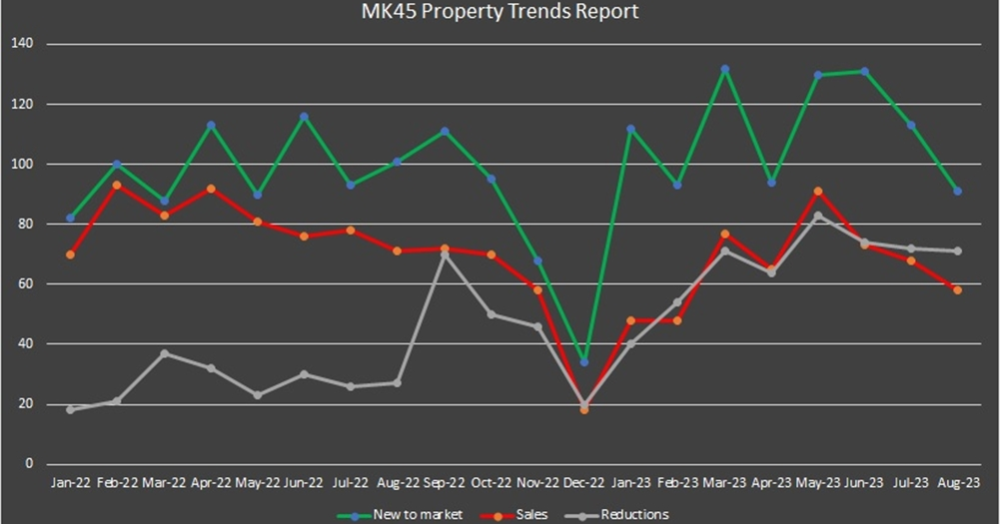

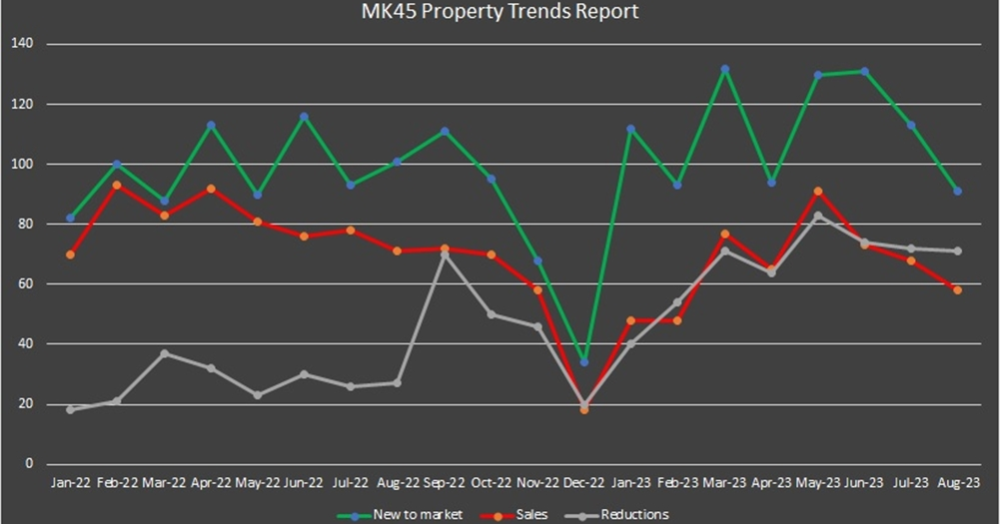

I have looked at the trends since the beginning of 2022, watching the peaks and the troughs and sharing an insight into what is happening in Flitwick, Ampthill, Barton-le-Clay and all the nearby villages.

Our latest figures show a downturn for both sales and properties entering the market in August while the number of properties being reduced remains somewhat similar to the last couple of months. The downturn is not unexpected given it is the peak of the holiday period and the reported high numbers of people booking last minute holiday sun following a pretty disappointing UK summer.

What I did find interesting was the proportion of properties reduced and the number of those which sold compared to the number of properties sold during the month.

38% of the properties which sold in August had been reduced at least once

The trends graph also shows that new properties being placed on the market has significantly declined in recent months the number of sales in the same period has not declined as much, this confirms a large proportion of sales have been agreed on reduced properties.

The average asking price reduction in August was 6% or £22,500

The average property price in MK45 is approx. £375,000 so a 6% reduction is an average reduction of £22,500. The largest I have seen is a reduction of 20% or £250,000 which was on a property initially marketed at £1.25m.

Nationally property prices up 0.1% compared in the last 12 months

The latest UK house price index produced by Zoopla shows a 0.1% increase in UK property prices last month compared to August 2022. The same report does show a small reduction in property prices in Eastern England and London of just 1%. So why are we seeing properties being reduced by 6x that regional figure?

As I have been reporting for a number of months this is due to a large number of properties being placed on the market at an over-ambitious price. This is sometimes by the advice of an agent but also can be an over-zealous homeowner. This over-ambitious pricing of properties leads to the housing market feeling worse than it really is however the majority of properties which sold in August did not have to reduce and were marketed at the correct level from the start.