Rightmove housing market report - March 2023

The Rightmove House Price Index is the largest, most up-to-date monthly sample of residential property asking prices. The index monitors changes in house prices both annually and monthly, providing a comprehensive view on the current state of the market. In this blog we look at the report and highlight areas which are impacting the local market.

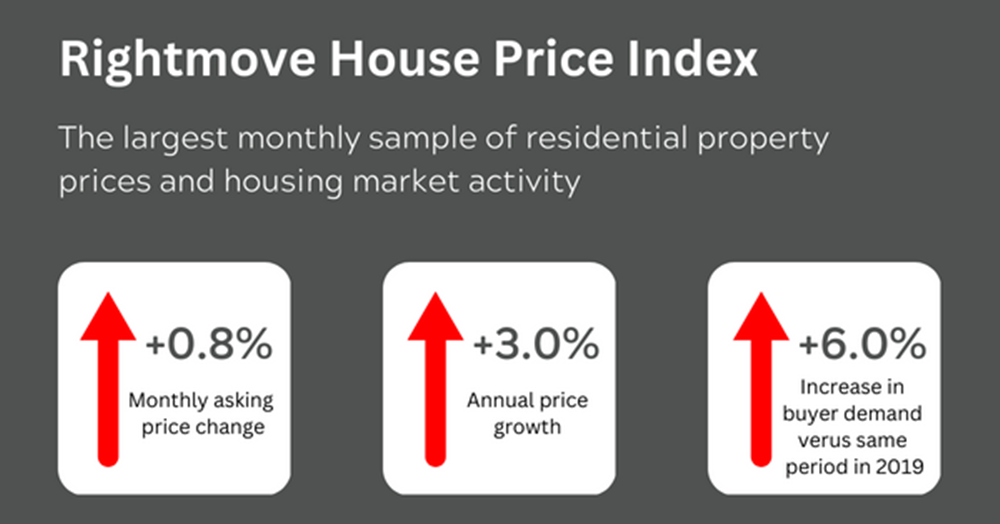

Newly released Rightmove data has revealed that the average price of property being put on the market has increased by 0.8% (+2,906) this month to £365,357. This monthly growth is a slightly below the typical average monthly rise of 1.0% seen in March over the last 20 years, as more new sellers opted to tread carefully than is usually seen at this time of year.

Rightmove have also noted that newly advertised properties have an asking price that is 3% higher than in March 2022 however the average asking price is £5,800 lower than it was at the peak of the market in October 2022. This slower growth points to a much more stable footing than many 'experts' predicted and we seem to be cautiously transitioning towards the more normal market we had pre-pandemic. The last few years of price increases were unsustainable but the market is cooling in a controlled manner rather than seeing a bubble burst.

First time buyer properties resisting the shift in market conditions

Typical first time buyer properties (1 & 2 bedroom properties) are leading the recovery with sales agreed in this sector improving the fastest. Locally we have been seeing a marked increase in the number of first time buyers and buy to let landlords agreeing purchases.

Increase in first time buyers and investment buyer likely to increase interest in the upper sectors of the market as those sellers are buying larger properties.

We are seeing many first time buyers who moved back from rented to be with parents during 2020's lockdown and have been able to save greater deposits without the large increases in cost of living. This has put them on a much better standing when looking for their first home.

Mortgage rates reducing dispite increasing Bank of England base rate.

Mortgage rates have fallen back from their peak last year, with average rates for a 15% deposit, five-year mortgage now 4.65% edging down from last months 4.75%, and October's 5.89%. For those with larger deposits or equity in their home 60% deposit, five-year mortgage are available at 3.99%.

Average time to find a buyer.

National figures show that it is taking longer to find a buyer, with an average of 36 days in February 2022 compared to 57 days in February 2023. This is unsurprising as the panic buying frenzy has left the market and with properties not selling as quickly buyers have more to choose from and less urgency so they can wait to find their dream home. Surely this is how it should be when making such an important decision? Some buyers are now viewing a property 3 or 4 times befor making an offer.

What does this mean to Bedfordshire homeowners?

While we expect to see a slip in annual price increases in 2023 this will be against a huge spike in asking prices between March 2022 and October 2022. The current softening of the market along with confidence of dirst time buyers and investment buyers should lead to a more sustainable housing market and help to avoid a bursting bubble. While we are unlikely to see huge increases in property prices for 2023 it is my belief that, looking at all the available market statistics property remains the safest place for your money.

If you are thinking about selling then it is more important than ever to choose the right marketing price, with the increase in choice and competition buyers are becoming spoilt for choice however market at the correct price and you will secure a sale at very close to this figure, marketing at a higher price is likely to invite offers at a much lower figure.

If you would like to discuss the current market and how it could impact your move please feel free to contact me directly on 01525 713111 or via email stuart@lovehomes.uk.

To read the report in full click here.